Can Swing Trading Actually Be Profitable?

The What, If and How Of Swing Trading

Swing trading can be a profitable strategy for those looking to make short-term gains in the stock market. The basic premise of swing trading is to hold onto a stock for a period of several days to several weeks, during which time the stock's price is expected to rise. This is in contrast to day trading, where a stock is bought and sold within the same day, or long-term investing, where a stock is held for months or even years.

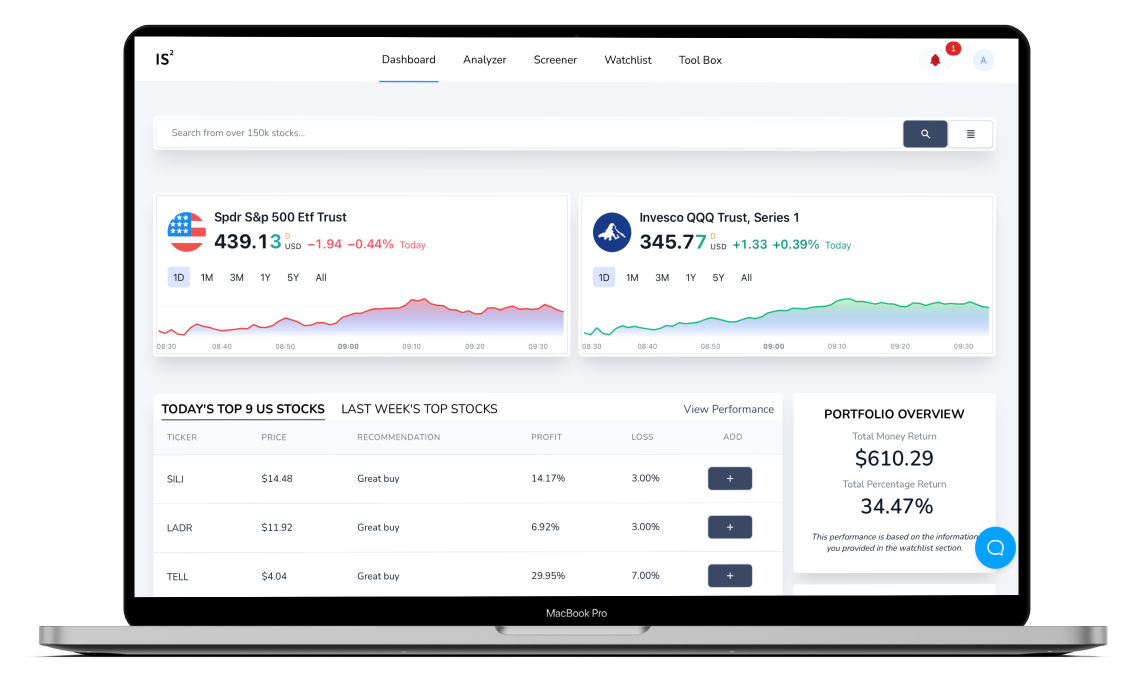

One of the benefits of swing trading is that it allows traders to capitalize on short-term market movements without the need for constant monitoring of the stock. This can be especially useful for those with busy schedules or other obligations that make it difficult to constantly monitor the markets.

Another advantage of swing trading is that it can be done with a relatively small amount of capital. This is because the goal is to make small gains on each trade, rather than trying to hit a home run with a single trade. This also means that the risk of loss is limited, as the trader is not investing a large portion of their capital into a single trade.

However, swing trading is not without its risks. One of the biggest risks is that the stock's price may not rise as expected, resulting in a loss. This can be mitigated by using stop loss orders, which automatically sell a stock when it reaches a certain price.

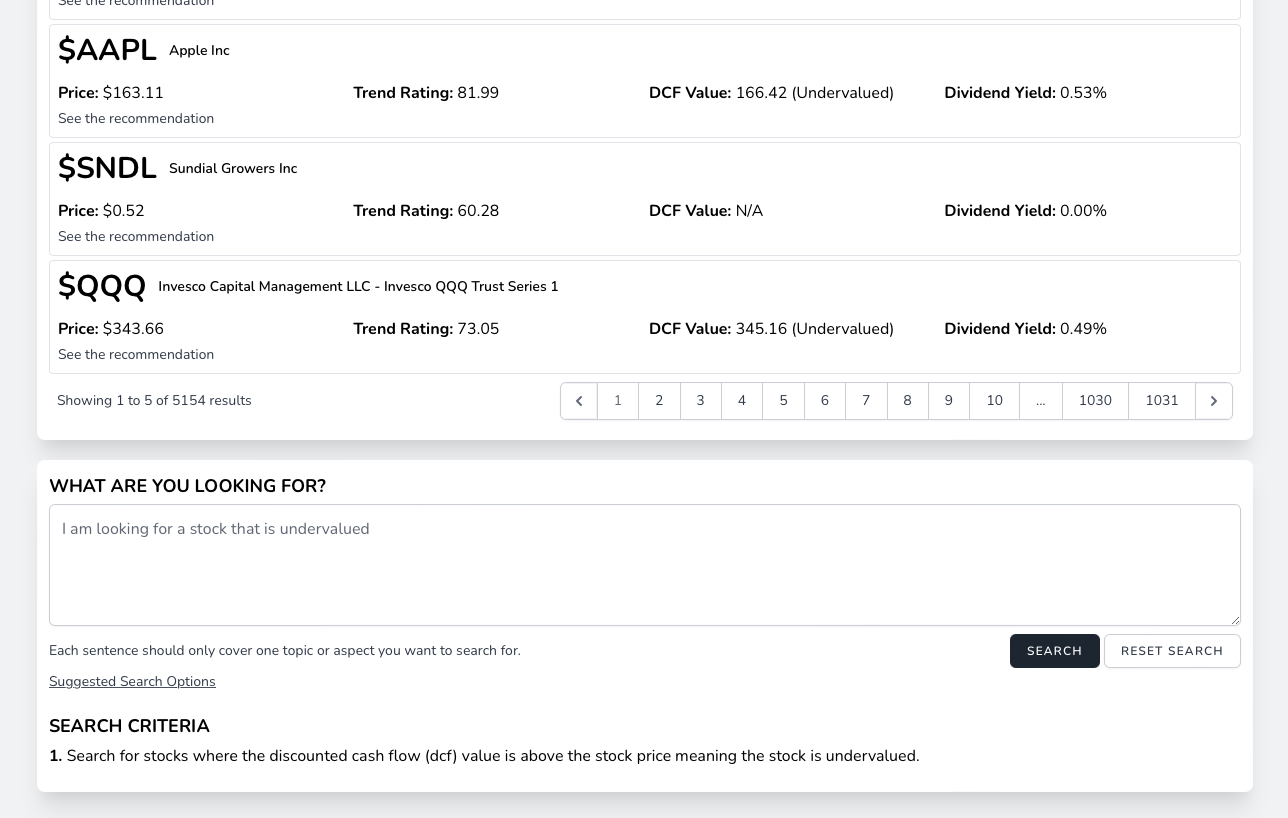

It is also important to have a well-defined trading strategy in place. This should include criteria for selecting stocks to trade, as well as rules for entering and exiting trades. It is also important to have a clear understanding of the market conditions, such as the overall trend of the market and any major news or events that may impact the stock's price.

In conclusion, swing trading can be a profitable strategy for those looking to make short-term gains in the stock market. It offers the benefits of flexibility and the ability to make small gains with limited capital. However, it is important to have a well-defined strategy in place and to be aware of the risks involved. As with any form of investing, it is important to always do your own research and never invest more than you can afford to lose.

Similar Blog Posts