How To Swing Trade Stocks Using Trend Following

Your Step By Step Guide To Trend Following

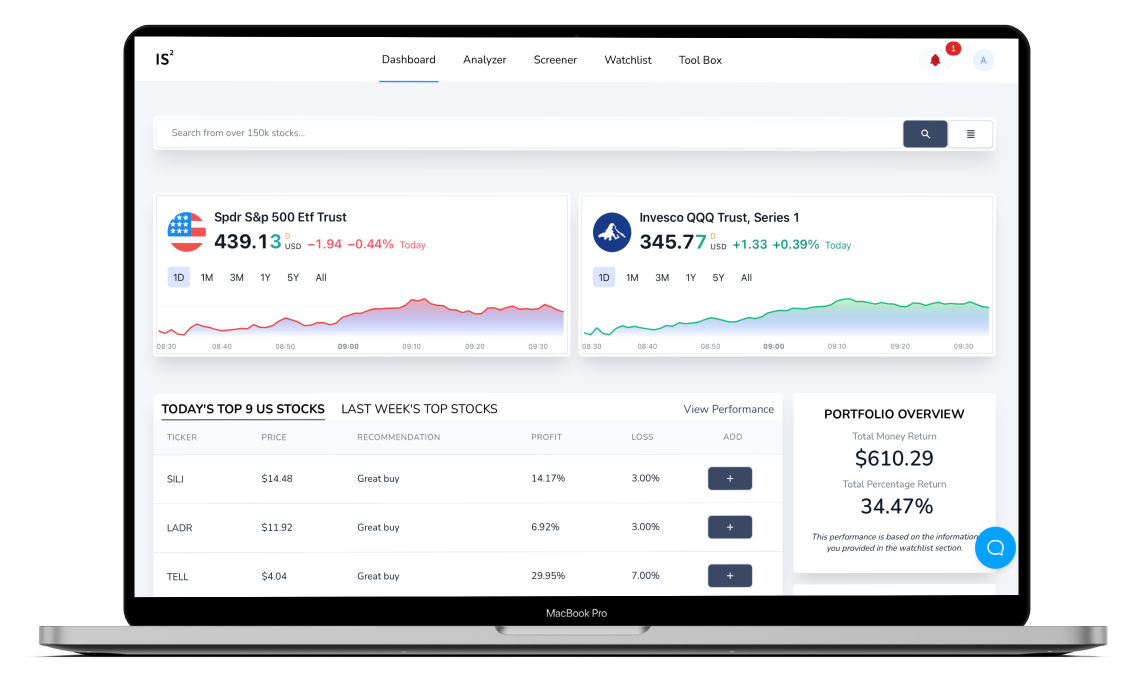

Swing trading stocks using trend following is a popular strategy that can be a profitable way to make short-term gains in the stock market. The basic premise of trend following is to identify the current trend of the market and then align your trades with that trend. By doing so, you can potentially profit from the market's upward or downward movements.

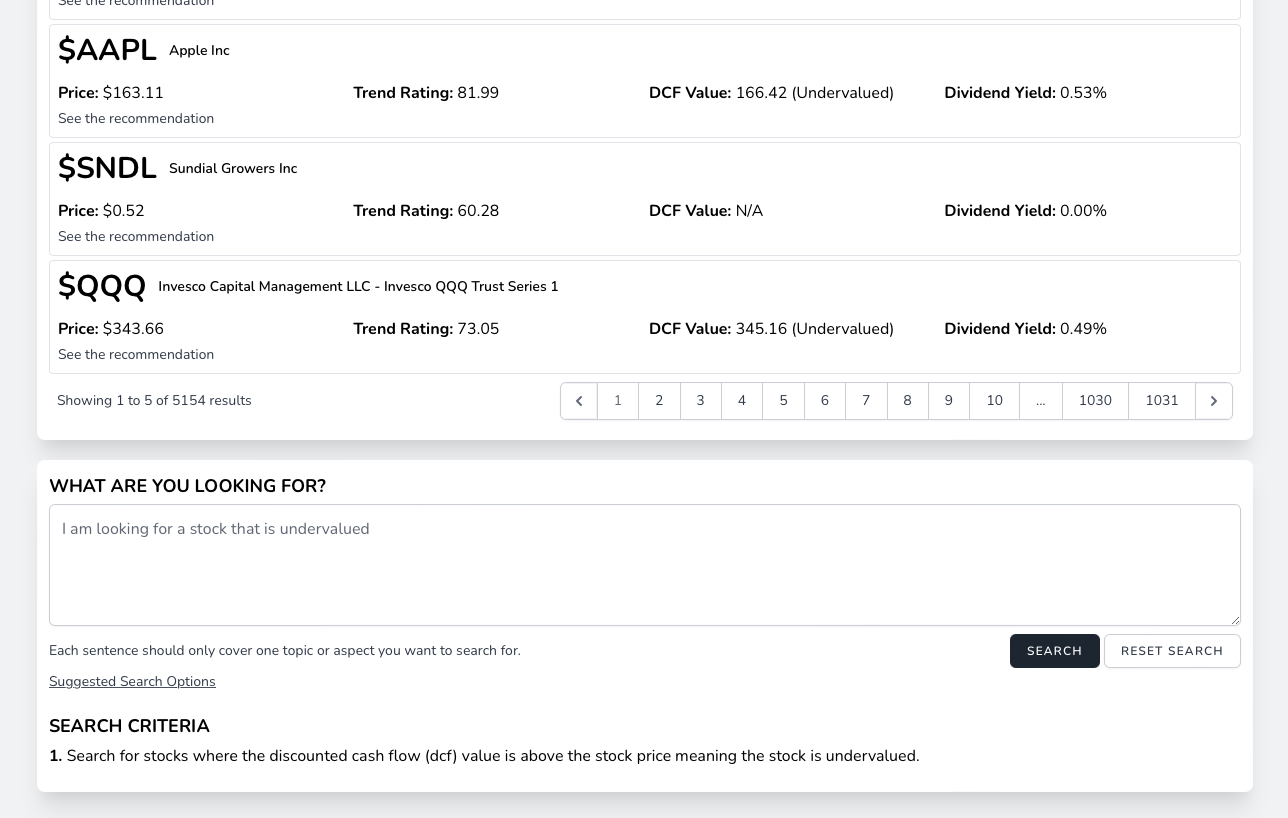

To begin swing trading using trend following, the first step is to identify the current trend of the market. This can be done by using technical indicators such as moving averages, which can help you identify the direction and strength of the trend. For example, if the 50-day moving average is above the 200-day moving average, it can indicate that the market is in an uptrend.

Once the trend has been identified, the next step is to select stocks that are aligned with that trend. This can be done by looking for stocks that are in an uptrend or downtrend, based on the trend identified by the technical indicators. It is also important to consider the overall health of the company, such as its financials and any recent news or events that may impact the stock's price.

Once you have selected a stock, the next step is to enter a trade. It is important to have a clear entry and exit strategy in place. For example, you can enter a long position when the stock breaks above a resistance level, or a short position when the stock breaks below a support level.

It is also important to have a risk management plan in place. This can include using stop loss orders, which automatically sell a stock when it reaches a certain price, and position sizing, which limits the amount of capital invested in each trade. This can help to limit potential losses and protect your capital.

In summary, swing trading stocks using trend following is a popular strategy that can be a profitable way to make short-term gains in the stock market. It involves identifying the current trend of the market, selecting stocks that are aligned with that trend, and entering and exiting trades with a clear strategy and risk management plan. As with any form of investing, it is important to always do your own research and never invest more than you can afford to lose.

Similar Blog Posts