Making Monthly Income With Covered Calls and Trend Trading

The easiest way to consistently profit from the market

Trading covered calls and trend trading are two popular strategies that investors can use to generate monthly income and potentially enhance their portfolio returns. These strategies can be applied to various types of securities such as stocks, exchange-traded funds (ETFs), and options. In this article, we will discuss the basics of these two strategies and how they can be used to generate monthly income.

Covered Calls

A covered call is a trading strategy in which an investor holds a long position in an underlying asset (such as a stock) and simultaneously sells a call option on the same asset. The call option gives the buyer the right, but not the obligation, to purchase the underlying asset at a specified price (strike price) before a certain date (expiration date). By selling a call option, the investor receives a premium that can be used as monthly income.

When trading covered calls, the investor has two objectives: to generate income and to limit their potential losses. The income generated from selling the call option can be used to offset the cost of holding the underlying asset, which reduces the investor’s overall cost basis. Additionally, if the stock price remains below the strike price, the investor can keep the premium and continue to hold the underlying asset.

However, if the stock price rises above the strike price, the investor may be required to sell the underlying asset at the strike price, which limits their potential gains. To mitigate this risk, the investor can choose to sell a call option with a strike price that is higher than the current market price of the underlying asset. This way, the investor can participate in some of the stock’s potential upside while still receiving income from the call option premium.

Trend Trading

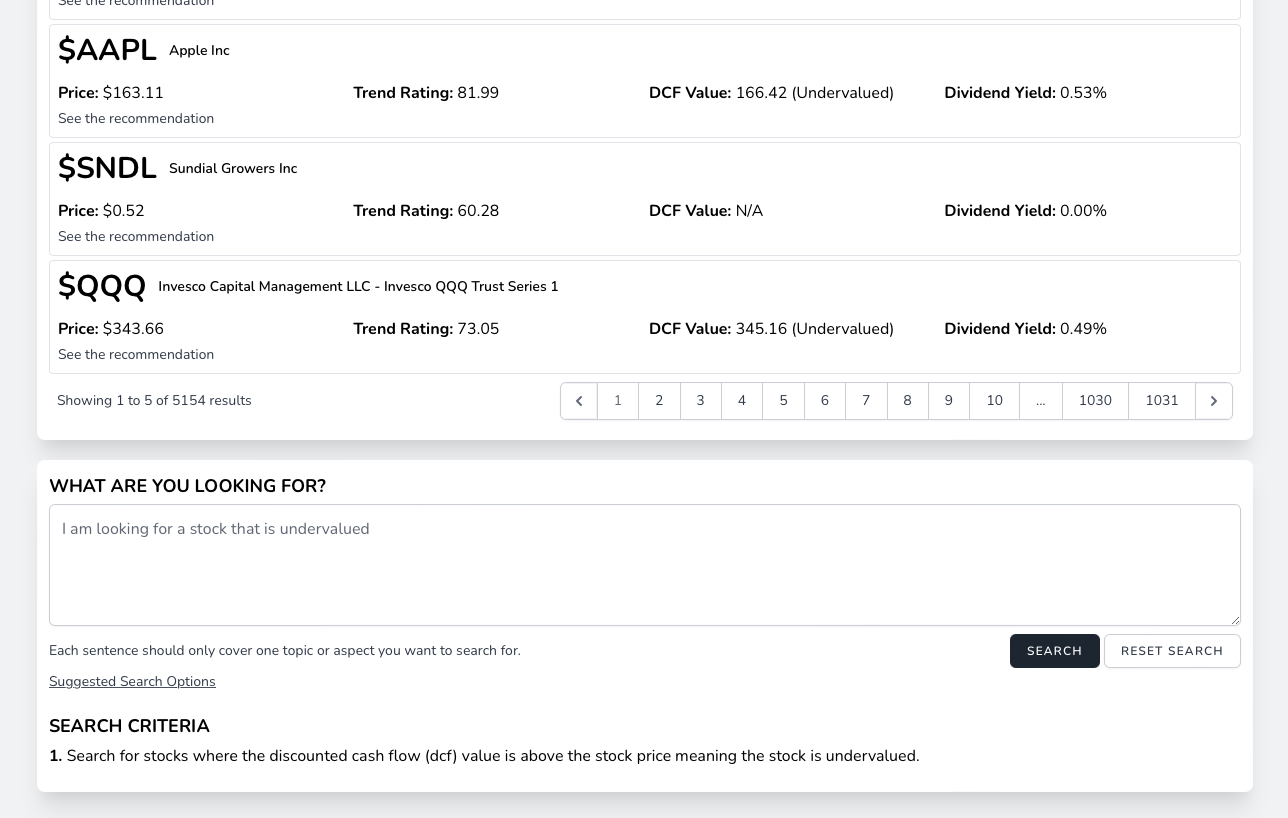

Trend trading is a strategy in which an investor buys or sells a security based on its current trend. A trend is a general direction that a security’s price is moving in over a certain period of time. Trend traders attempt to identify and ride the current trend, either by buying into an uptrend or shorting a downtrend.

In trend trading, the key to success is being able to identify the trend early and ride it for as long as possible. One way to do this is by using technical analysis tools such as moving averages, support and resistance levels, and trend lines. Trend traders may also use a combination of technical and fundamental analysis to make their decisions.

Trend trading can be applied to a variety of securities including stocks, ETFs, and commodities. For example, an investor may use trend trading to invest in a stock that has a strong uptrend, riding the stock higher as long as the trend remains in place. On the other hand, an investor may short a stock that has a strong downtrend, selling the stock and then buying it back at a lower price.

Using Trend Trading and Covered Calls Together

By combining trend trading and covered calls, investors can potentially generate monthly income while participating in the potential gains of a security. For example, an investor may use trend trading to identify a stock that is in an uptrend and then sell a covered call on that stock to generate income. This way, the investor can potentially receive income from the call option premium while also participating in the stock’s potential upside.

Additionally, by using trend trading, the investor can potentially increase the chances of making a profit from the covered call. For instance, if the investor identifies a stock that is in a strong uptrend, the likelihood of the stock price reaching the strike price of the call option is higher, which increases the chances of the call option being exercised.

Conclusion

In conclusion, trading covered calls and trend trading are two strategies that investors can use to generate monthly income and enhance their portfolio returns

Similar Blog Posts